007 AI Financial Advisory

Build a 007 agent leveraging multiple LLMs for financial analysis

Getting Started / Prerequisites

Before diving in, ensure you have access to IBM Cloud, the necessary API keys, and a basic understanding of AI and data integration. This guide is designed for developers ready to implement a real-world solution with clear, step-by-step instructions.

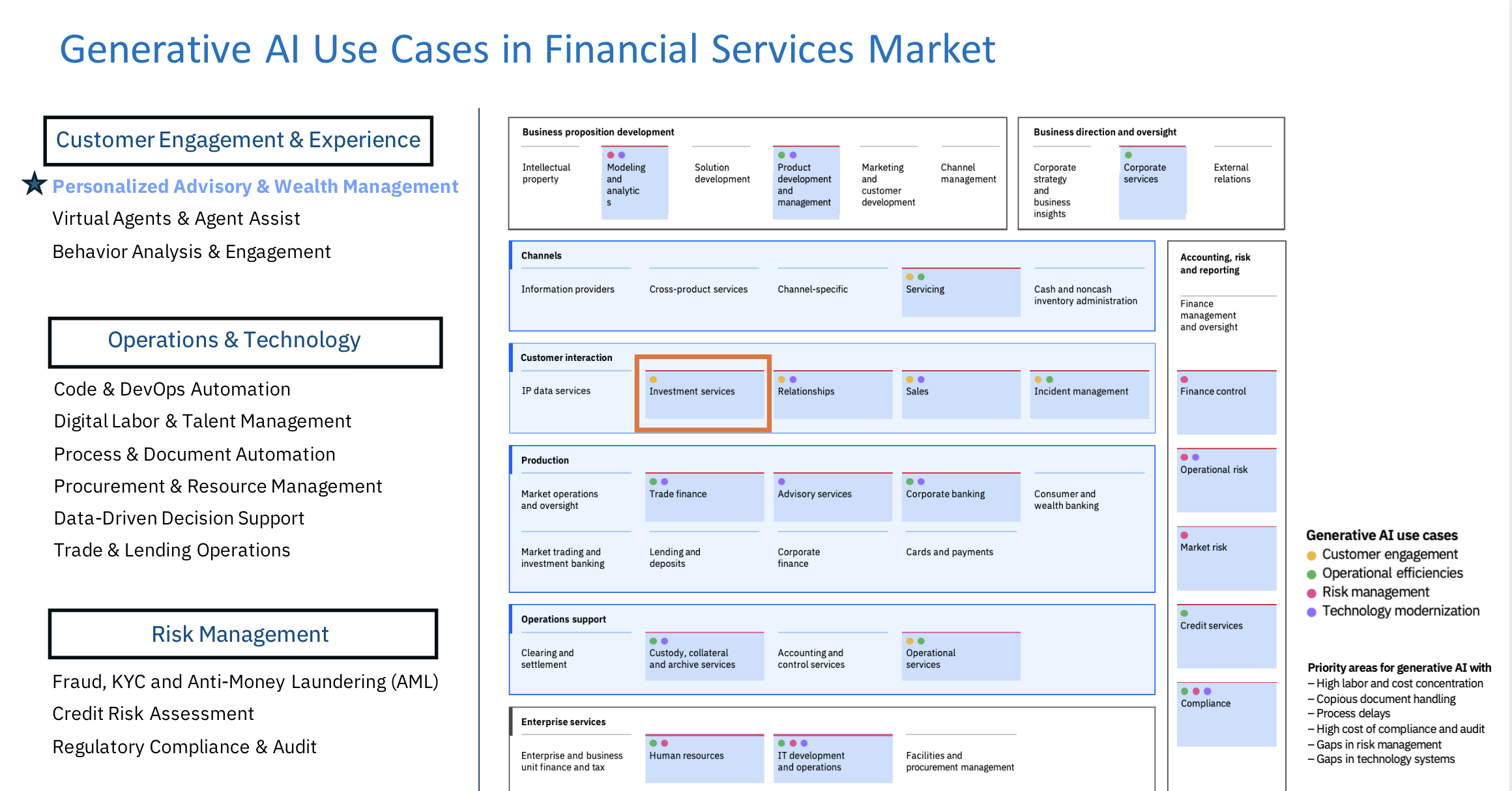

The Why

Financial advisors operate in a rapidly changing regulatory and market environment, where clients expect personalized, tax-efficient, and well-diversified strategies. Constantly shifting tax regulations, market volatility, and manual processes create a perfect storm that makes it difficult for advisors to:

- Stay compliant.

- Deliver optimal portfolio outcomes.

- Efficiently communicate and scale services to multiple clients.

Problem Details

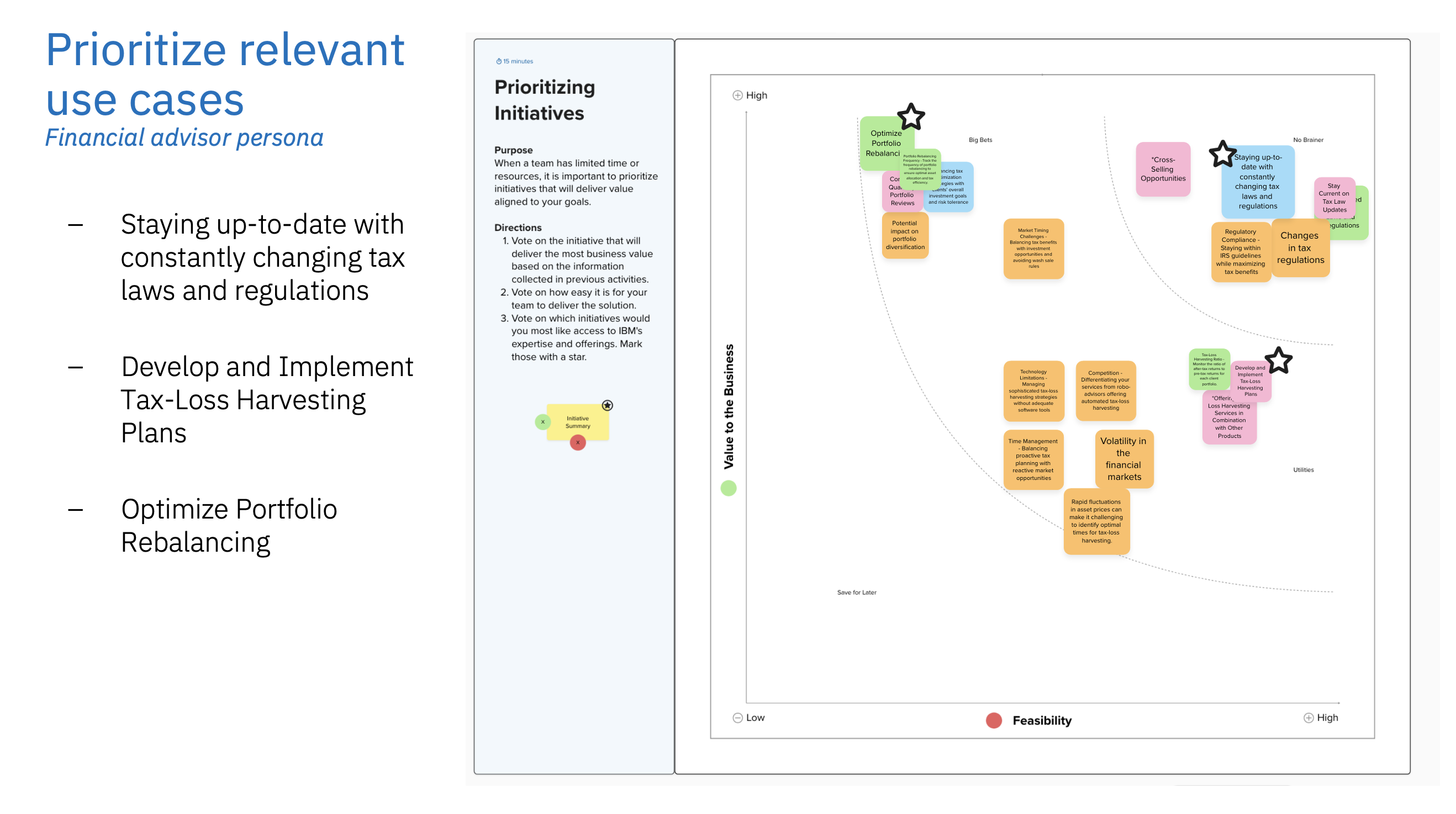

Advisors face issues like keeping up with tax regulations, managing portfolio diversification, and timely communication—all compounded by market volatility and regulatory risks. This guide outlines how automation and AI can help mitigate these challenges.

Additional Context

These challenges were identified during a feasibility assessment using local LLMs (e.g., Llama 3.2, Granite 3.0 via ollama) and collaborative workshops. The goal is to streamline operations, reduce compliance risks, and augment financial advisor processes with AI and automation.